The air,

we might say,

is the soul of the visible landscape,

the secret realm from whence all beings draw their nourishment

David Abram

Using modular Options to scaffold bioregional infrastructures

Bioregional economies straddle multiple worlds. There is the urgent need to fiercely defend ecosystems from predatory land grabs, extractive markets and financialisation. At the same time, practitioners are navigating the need for enabling financial backing, legal and political legitimacy, whilst building the systems and processes of a future they are already living.

Bioregional economies straddle multiple worlds. There is the urgent need to fiercely defend ecosystems from predatory land grabs, extractive markets and financialisation. At the same time, practitioners are navigating the need for enabling financial backing, legal and political legitimacy, whilst building the systems and processes of a future they are already living.

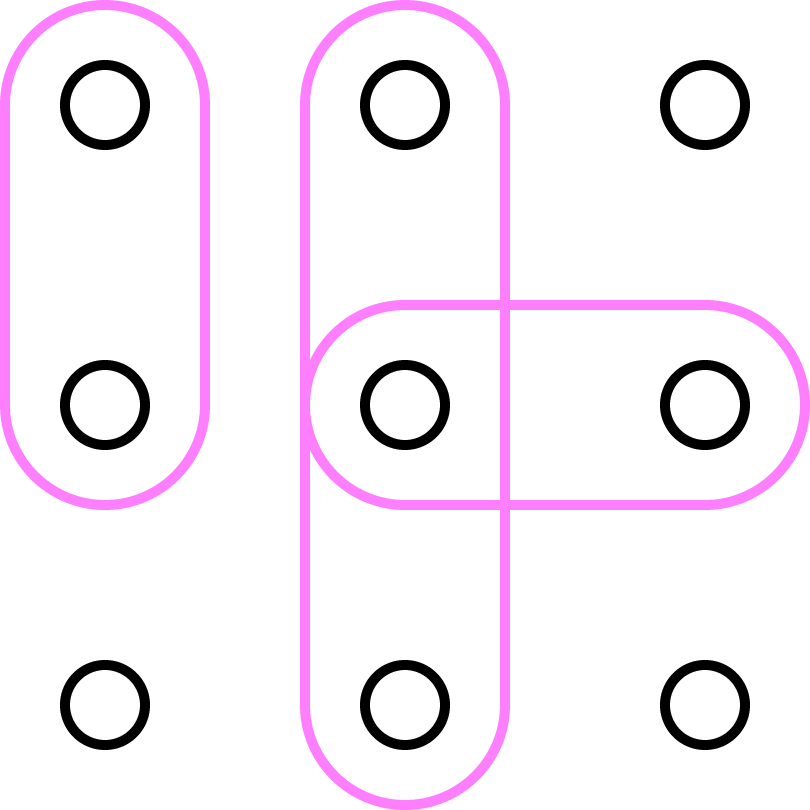

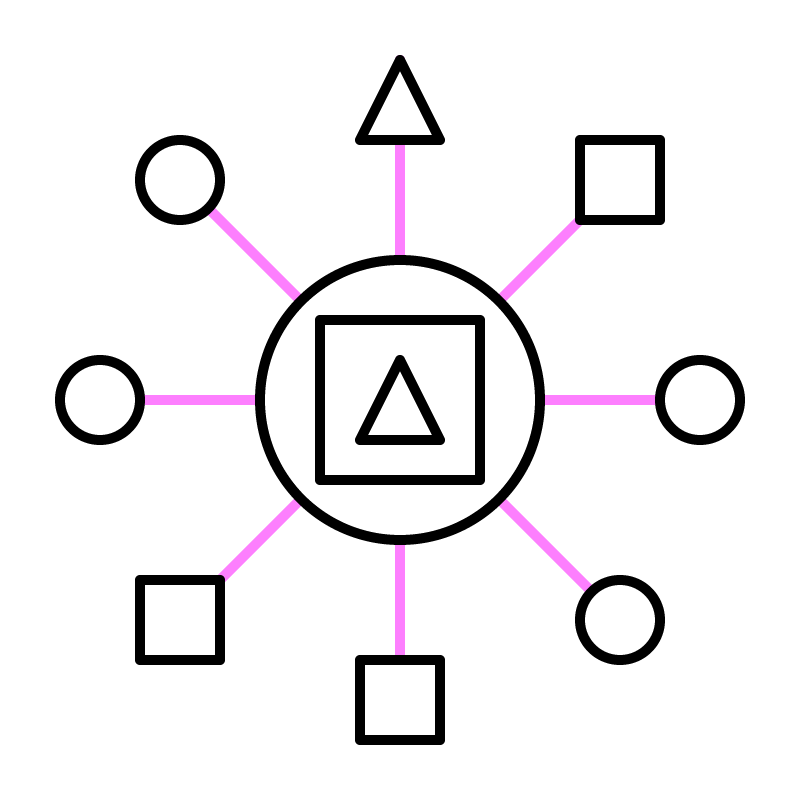

The landscape is evolving rapidly and needs vary. Within this context our strategy is to propose and build towards a portfolio of real world options (tools, frameworks, processes, infrastructures and institutions), that will scaffold the transition and form the building blocks of the next bioregional economies. Options can be used as tangible, interoperable modules that will grow in complexity over time. In the early stages of a bioregional journey, it might only be practical to engage with one or two (for example, building a project database and developing non-linear Cornerstone Indicators). As the work progresses, these early stage options can be linked to others to form institutions such as Venture Studios and Bioregional Banks.

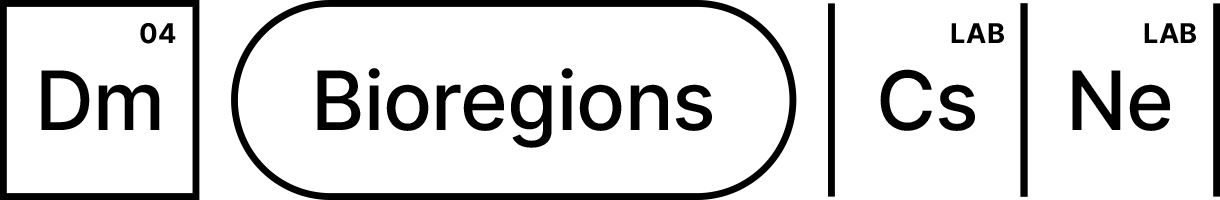

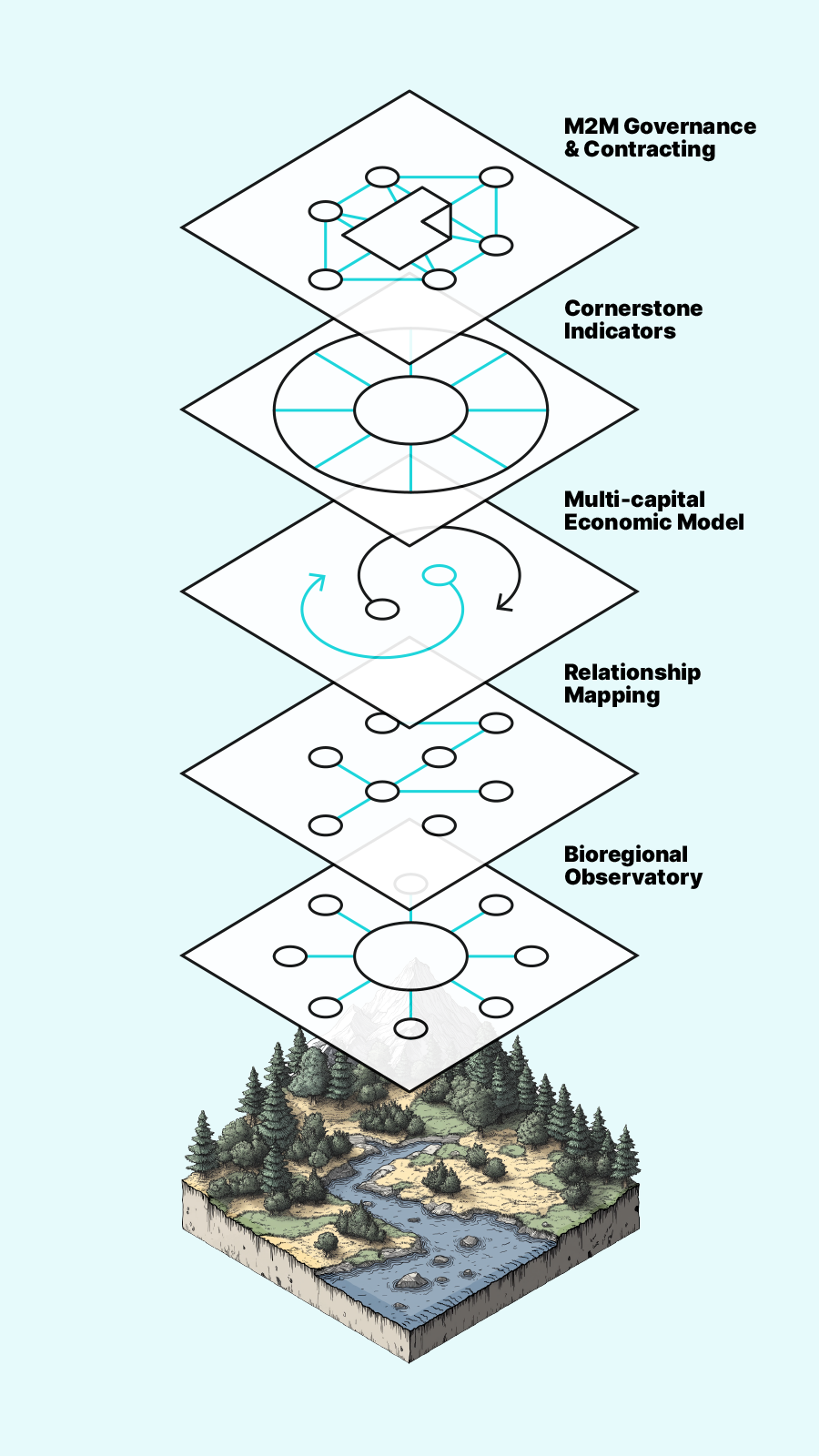

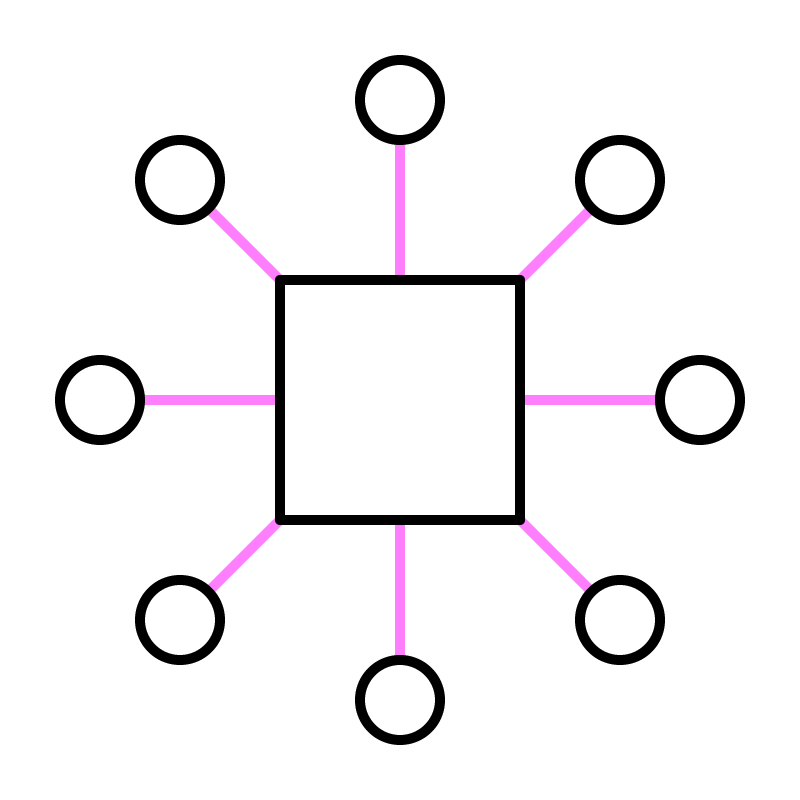

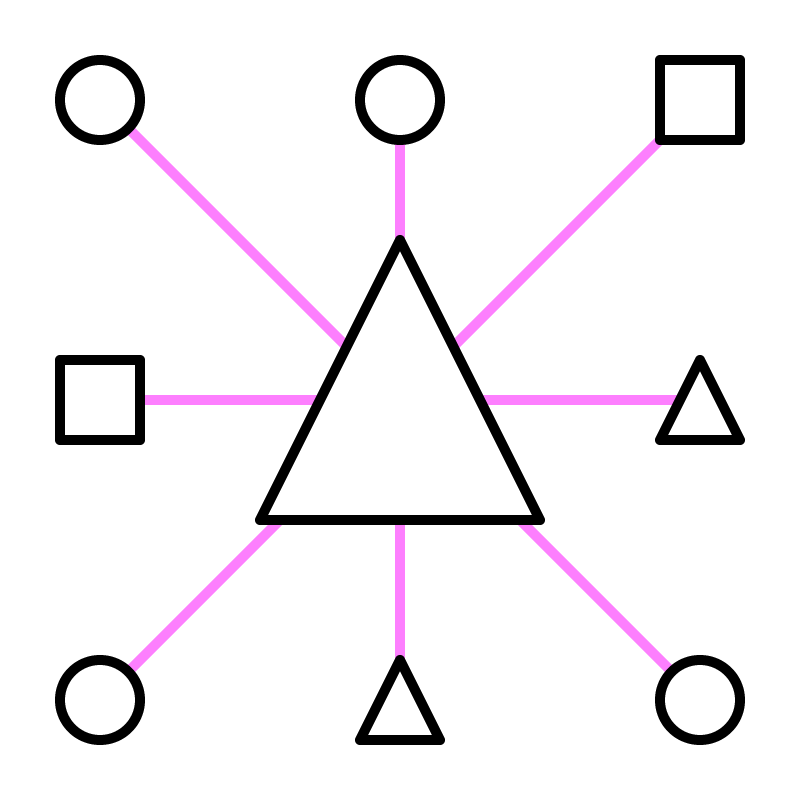

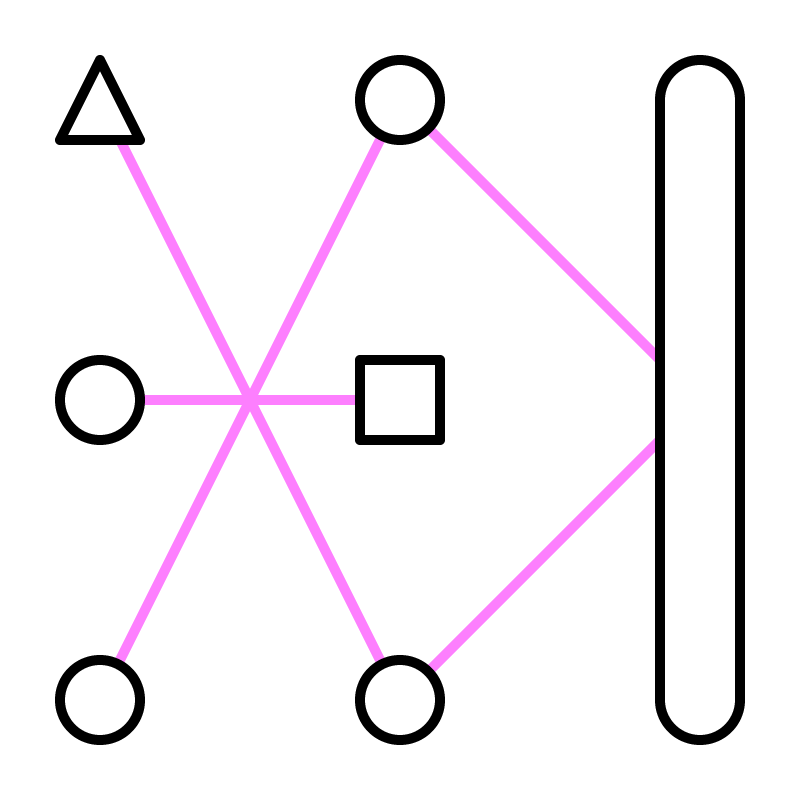

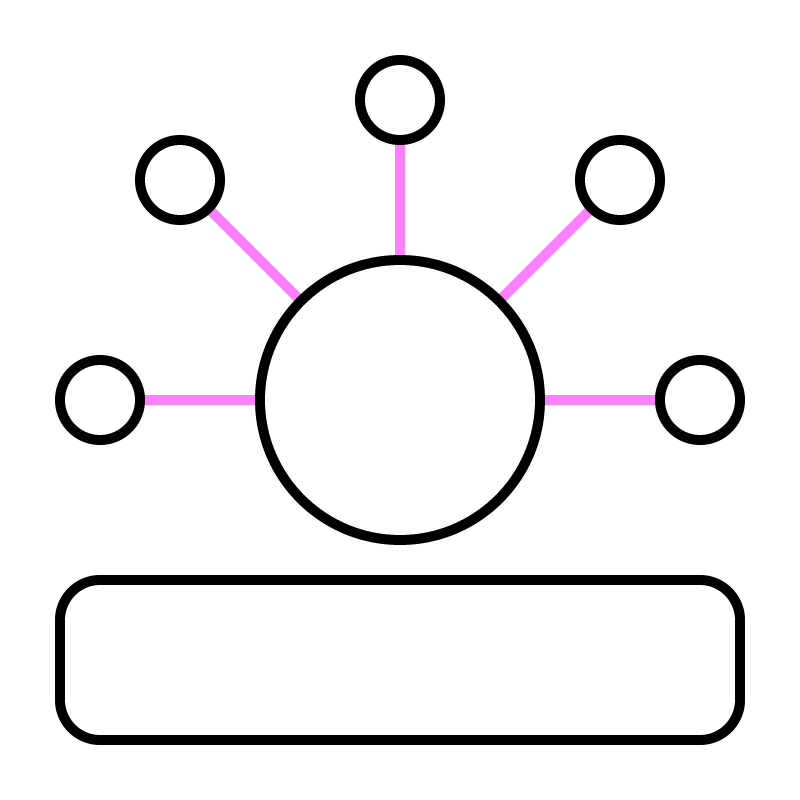

Dm is actively working on developing thematic option stacks across multiple workflows. The visualisations below show some current use cases, but the modular options can be used in a configuration that is most appropriate to your context.

Economics Stack

Finance Stack

Economics Stack

Bioregional

Observatory

An intelligence and sense-making function dedicated to tracking, understanding, and communicating the evolving health and dynamics of a bioregion across ecological, cultural, social, and economic dimensions. More than a data centre, it provides a shared lens for communities and institutions to monitor change, and guide action priorities and capital flows.

- What metrics and narratives can authentically capture bioregional health in a way that supports both community legitimacy and investment-grade confidence?

- How can observation and sense-making be decentralised while maintaining coherence, interoperability, and trust?

- How are human and technological sensing combined in the best way possible?

Relationship

Mapping

A process for combining on-the-ground research with existing data, to identify the known and potential implications of an intervention. A typology of benefits and disbenefits is used to map the identified value flows and suggest proxies for quantifying them. The outputs link to the Multi-Capital Model to set the parameters of diverse value flows that should be represented.

- How can we connect complimentary (but currently siloed) skillsets such as accountancy and system mapping?

- How can we visualise relational chains of value flow?

Multi-capital

Economic Model

The multicapital model links the financial cycle of an organisation to the wider economic value flows. By visualising where the intersections of the two cycles exist, it is possible to support income streams such as revenue share percentages, outcomes based financing or regulatory planning payments (e.g. biodiversity net gain) and to underpin new financial methodologies (for example, developing multicapital financing instruments).

- How do we navigate the extractive risk of monetising natural value flows?

- Where is it possible to push the edges of the current financial system to shift the underlying logic of investment?

- How can we work generatively with the local accountants who are already supporting bioregional organisations?

Cornerstone

Indicators

A framework to create contextual, non-linear indicators of holistic outcomes. By using a flexible typology, the indicators can be easily customised by the people working closest to the outcomes of interest.

- How can we honour the intrinsic value of living systems whilst striving for robust decision making inputs?

- Can indicators become embodied expressions of care and respect?

- How do local land stewards communicate value to market actors in a way that feels authentic and generative?

m2m Governance &

Contracting

The M2M option builds on the lower levels of the stack to crystalise the identified value flows into digital, multi-actor risk sharing agreements. The process combines the trust and values of in-depth, respectful relationship building with the technological capacity of digital contracting.

- How do we shift the power dynamics of traditional private agreements to share risk and rewards in a transparent, equitable way that is flexible to shifting conditions?

- How can we represent non-human interests?

Finance Stack

Project Database &

Portfolios

A living repository and strategic organising tool for regenerative initiatives in a bioregion, enabling visibility, matchmaking, and aggregation for funders, communities, and intermediaries. Portfolios group projects by synergies, shared outcomes, geographies, or risks to facilitate learning, integrated financing, and systemic leverage.

- What information architecture and data standards are needed to capture and communicate the full regenerative potential of projects and portfolios?

- How are virtuous portfolios actually constructed?

- What does “investability” mean in the context of systemic portfolios?

Catchment

Trusts

Place-based, multi-stakeholder governance and resource allocation vehicles that steward the health of a sub-bioregional catchment. They hold legal and fiduciary responsibility for aligning catchment health with bioregional health.

- What governance structures embody polycentricity and reciprocity to ensure legitimacy, adaptiveness, and deep local accountability?

Risk Holders

Alliance

A coalition of institutional and private actors—such as utilities, insurers, local authorities, and landowners—who share exposure to cascading systemic risks and commit to pooling of resources for collaborative investment in bioregional-scale interventions that mitigate those risks.

- What does the social process look like for risk holders to come together and create shared allocation agreements?

- Which overlapping risks are significant enough to incentivise cross-sectoral collaboration and co-investment?

- What legal/ contractual frameworks are needed to support the pooling of liabilities and assets?

Outcome

Accelerators

A temporary programme that helps complex multi-stakeholder ecosystems to identify, co-create, and iterate ways of overcoming systemic barriers toward mutually agreed outcome goals.

- What capabilities and intermediaries are needed to bring the whole system together and orchestrate toward outcomes?

Regen

Funds

A fund designed to allocate capital in a way that strengthens the full ecosystem of a place-based regenerative economy. It has the capacity to recognise, price, and regenerate value while embedding new and existing models of shared ownership, many-to-many governance, collective intelligence, and models that honour multiple forms of capital present in a system.

- What are the archetypes and motifs of allocators in regenerative funds?

- What does a regenerative capital stack look like? And how is it orchestrated?

- How can multi-capital returns be structured?

Bioregional

Bank

A place-based financial institution that roots money creation in the systemic health of a specific bioregion and supports projects aligned with that mission.

- What forms of value can be credibly recognised, measured, and used as the basis for capital issuance and allocation?

Acknowledging the gaps and inviting an ecosystem approach

As a multi-disciplinary team with an international presence we have diverse exposure to existing and new problem space. However, we fully acknowledge that we are not always best placed to respond to the gaps and challenges that we are seeing, due to a lack of capacity, technical expertise, or both. We will use the section below to flag challenges which we think are important as an invitation for others to take the lead.

Is there something from your viewpoint that you think is needed? Or perhaps you have a partial solution that you would appreciate support from others in the field to progress? If there is something that you would like to signpost to the field then please contact us via our Substack and we can help to make it known to people here.

Open challenges:

- Demystifying financial instruments and funds: financial design still feels like a ‘black box’ practice that excludes the people who have the greatest contextual knowledge of the real sources of value that underpin them. We see an opportunity to develop educational content, workshops and coaching support to shift this dynamic.

- Project incubation and acceleration: once the Bioregional Regeneration Strategy is created and the existing portfolio of projects, initiatives and ventures is mapped, new ones will need to be incubated and existing ones supported in their journey towards more (systemic) impact.

- Professional support studio: there is a growing need to match professional skills in areas such as financial modelling and statistical forecasting with bioregional initiatives. Traditionally access to these services has been expensive and difficult to engage with, but we are increasingly being approached by specialists who would like to fill this gap.